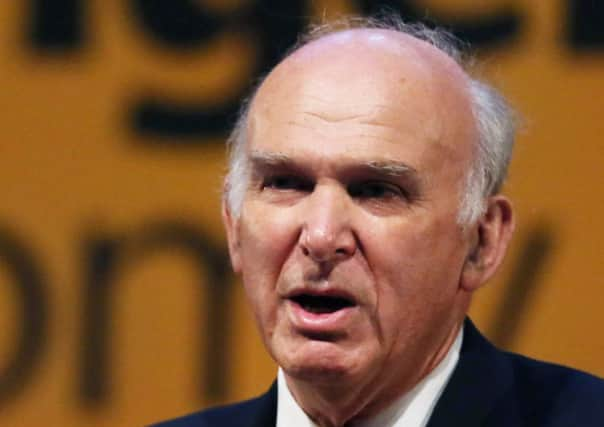

Scottish independence: Cable warns of VAT on food

Mr Cable’s evidence to the Commons business, innovation and skills committee, was dismissed by the SNP as “ridiculous”.

But the business secretary also warned that Scotland’s reapplication to the EU would be more complicated than being portrayed by the nationalists and suggested it would take longer than the 18 months envisaged in the independence White Paper.

Advertisement

Hide AdAdvertisement

Hide AdIn answer to a question from Tory Gosport MP Caroline Dinenage, Mr Cable pointed out that the UK is one of the few countries which is allowed a zero per cent VAT on certain goods including food and children’s clothes.

He said that new applicants had to accept the EU minimum of five per cent and warned there would be “different VAT rating on areas of household budgets” either side of the Border.

He said it was an example of how economies on both sides of the Border will diverge considerably with different currencies.

“The divergence could happen in a variety of ways if, as we feel is likely, Scotland did acquire its own currency, because that’s what independence would really lead to,” he said.

“That clearly affects the rate of exchange, and potentially with an oil-based economy on one hand and a more broadly based UK on the other those divergences and exchange rates can be very considerable and effect business costs on both sides of the border.

“The divergence would take a more extreme form if you have different exchange rates but I think we’ve argued that would be almost certainly an inevitable consequence of independence because the currency union isn’t really sustainable.”

The Business Secretary also gave his view on EU membership for Scotland and the future of banking.

The Royal Bank of Scotland may choose to move its headquarters to London, he suggested, because it would want to be in the same country as the lender of last resort - the Bank of England.

Advertisement

Hide AdAdvertisement

Hide Ad“If you were managing RBS, I think you would almost certainly want to be in a domicile where your bank is protected against the risk of collapse,” he said.

“They already have a substantial amount of their management in London and I would have thought, inevitably, they would become a London bank which would be symbolically quite important.”

He questioned how straight forward Scotland’s route to EU statehood would be.

The Scottish Government expects to negotiate terms in 18 months between a vote for independence and formally leaving the UK.

Mr Cable said: “One simply can’t predict, as in several other major areas of policy, what the consequences of that hiatus would be.

“Our understanding is that both legally and in terms of the politics of the European Union it would actually be quite difficult to migrate Scotland to independent membership.

“It may well prove to be trouble-free - we don’t know. There is simply a big uncertainty around the whole process. It could take a long time, it could take a short time.”

His comments were rejected by the Scottish Government and SNP which said the VAT question would not be an issue because Scotland “would not be rejoining the EU but renegotiating its terms of membership.”

Advertisement

Hide AdAdvertisement

Hide AdOn RBS an SNP spokesman said: “Vince Cable’s ridiculous comments are at odds with the common sense remarks from RBS’s Chief Executive, who last week said that if they had to operate in 39 countries around the world rather than 38, that is exactly what they would do.

“Mr Cable has unwittingly highlighted exactly why polls show the vast majority of people in the rest of the UK would expect the Westminster Government to agree to a currency union with Scotland.”

He went on: “The pound is as much Scotland’s as it is the rest of the UK’s, and the Fiscal Commission Working Group, with experts including two Nobel Laureates, have concluded that it’s in the interests of both Scotland and the UK to continue to retain Sterling in a formal monetary union.

“As Scotland is the UK’s second largest trading market, it would be absurd for Vince Cable or anyone else at Westminster to stand in the way of protecting the benefits this brings to businesses and consumers in the rest of the UK.”

SEE ALSO